Rising wedge vs falling wedge: what’s the difference? You can try out the IG trading platform with a demo account. To spot them, though, you’ll need a platform with powerful charting tools: such as the IG trading platform or MetaTrader 4. Studies have shown that falling wedges lead to breakouts slightly more often than rising ones. This is a sign that bullish opinion is either forming or reforming. But in this case, it’s important to note that the downward moves are getting shorter and shorter. When a market is falling, they’re a sign that traders are reconsidering the bear moveĪs with their counterpart, the rising wedge, it may seem counterintuitive to take a falling market as a sign of a coming bull move.

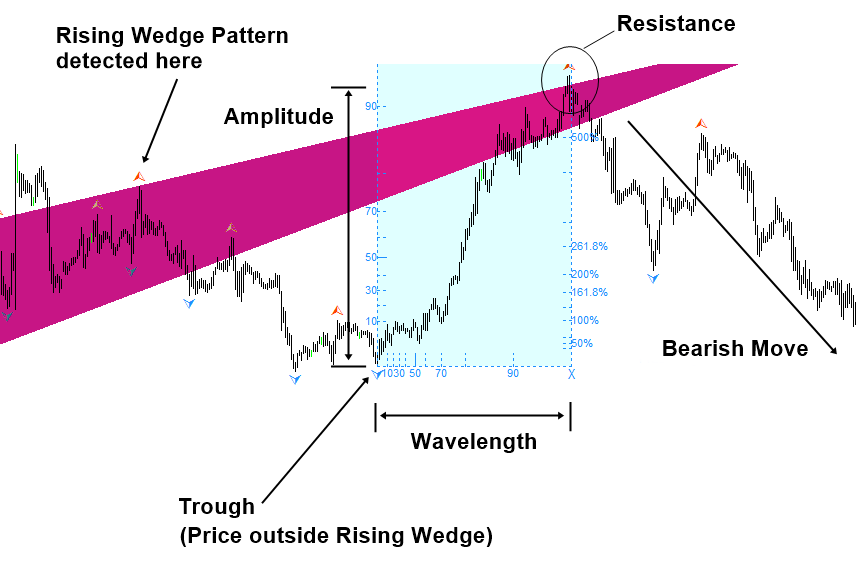

When a market is on an uptrend, they represent a short-term pause before the long-term move takes hold once more.So it also often leads to breakouts – but while ascending wedges lead to bearish moves, downward ones lead to bullish moves. To form a descending wedge, the support and resistance lines have to both point in a downwards direction and the resistance line has to be steeper than the line of support.Ī falling wedge is essentially the exact opposite of a rising wedge. The falling wedge chart pattern is a recognisable price move that is formed when a market consolidates between two converging support and resistance lines. Open an IG account to start trading them now. Rising wedges can occur on any market that’s popular with technical traders, including indices, forex and stocks. This causes a tide of selling that leads to significant downward momentum. Those waiting to short the market, meanwhile, will jump in. This negative sentiment builds up, so that when the market moves beyond its rising support line, anyone with a long position might rush to close their trade and limit their losses. This is the sign that bearish opinion is forming (or reforming, in the case of a continuation). But the key point to note is that the upward moves are getting shorter each time. After all, each successive peak and trough is higher than the last. When a market is falling, they’re a short-term pause before the bear market takes hold once moreĪt first glance, an ascending wedge looks like a bullish move.When a market is in an uptrend, they’re a sign that traders are reconsidering the bull move.In the case of rising wedges, this breakout is usually bearish.Īscending wedges can occur when a market is rising or falling: Investing in or trading crypto assets comes with a risk of financial loss.Like head and shoulders, triangles and flags, wedges often lead to breakouts. The views and opinions stated by the author, or any people named in this article, are for informational ideas only, and they do not establish the financial, investment, or other advice. RSI is at 43 and is heading towards neutrality to register the token’s bullish rally. Technical indicators suggest the uptrend momentum of XTZ coin. XTZ bulls need to maintain the volume in their favor to let XTZ surge. However, volume change can be seen below average and needs to grow for Tezos coin to surge over the daily price chart. The token is trying to gain uptrend momentum to surge towards the upper trendline over the daily price chart. Tezos price just got support from the lower trendline of falling wedge pattern over the daily price chart. The MACD line is crossing the signal line upwards for a positive crossover. MACD exhibits the bullish momentum of XTZ coin.

Relative Strength Index showcases the bullish momentum of XTZ coin. XTZ coin price is trying to surge towards the upper trendline of the falling wedge pattern.

0 kommentar(er)

0 kommentar(er)